Australia’s Property Market: A Balancing Act Between Growth and Affordability

Australia’s property market has been a topic of significant discussion due to its robust growth over the past decade, leaving potential homeowners grappling with high prices amidst a cost-of-living crisis. Maria Gil’s insightful article, “What will slow property prices down? How Australia can rein in its price rises,” dives deep into this pressing issue, shedding light on the complex dynamics at play.

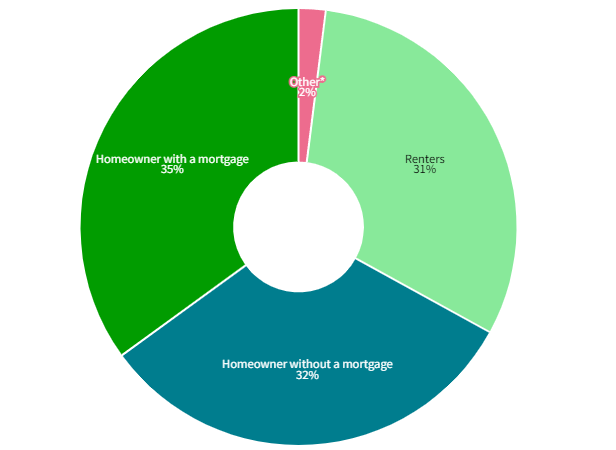

According to Dr. Nicola Powell, Domain’s chief of research and economics, the majority of Australians are property owners who benefit from rising prices, which complicates the push for affordability. “The vast majority of the Australian population owns property, and they don’t want to see one of their biggest financial assets going down in price,” Powell explains. This sentiment underscores the resistance against significant market downturns, suggesting that even a mild slowdown could substantially aid those struggling to enter the market.

The debate around solutions is contentious. Sean Langcake, head of macroeconomic forecasting at BIS Oxford Economics, argues that while increasing housing supply by developing new suburbs seems straightforward, it does not automatically lead to affordability. He points out that new suburbs, like Oran Park in Sydney, can still feature steep median house prices, making them inaccessible to many.

Government intervention could play a critical role, though its feasibility remains questionable. “If a government decided that it was politically popular enough for them to really do something, I think that they would,” Langcake says. However, he also notes a “fairly silent majority” content with the status quo, benefiting from asset appreciation.

One of the proposed solutions is the elimination or reform of stamp duty, which could lower the barriers to buying and selling homes, particularly for those looking to downsize. “Eliminating stamp duty could give people the incentive to buy homes that suit their needs,” states Powell, highlighting how this change could benefit empty nesters.

However, the necessity for moderated property price growth is emphasized by UNSW professor Chyi Lin Lee, who warns of the dangers of unchecked increases. “People should be worried if the housing market keeps increasing by double digits every year. That is dangerous,” Lee cautions, indicating that such growth rates could push people out of the market and potentially signal a looming housing bubble.

Ultimately, for Australia’s property market to achieve sustainable growth, a shift in perception is required. As Lee puts it, housing should be viewed “more as a place to live” rather than just an investment vehicle. This cultural shift, combined with governmental reforms advocated by influential groups like the bank of mum and dad, might pave the way for more equitable property price growth.

Both Maria Gil and the experts she quotes provide a comprehensive overview of the challenges and potential solutions that could lead to a more balanced property market in Australia. Their insights are crucial for policymakers, economists, and citizens alike as they navigate the complexities of housing affordability.

References:

https://www.domain.com.au/news/what-will-slow-property-prices-down-1315519/

Melissa Fisher

Founder, Acuity Development Group & The Right Team